😎 공부하는 징징알파카는 처음이지?

다변량 시계열 데이터 2 (Multivariate Time Series Data) 본문

👩💻 인공지능 (ML & DL)/Serial Data

다변량 시계열 데이터 2 (Multivariate Time Series Data)

징징알파카 2022. 9. 30. 09:54728x90

반응형

220930 작성

<본 블로그는 ysyblog 님의 블로그를 참고해서 공부하며 작성하였습니다>

https://ysyblog.tistory.com/298

[시계열분석] 다변량 선형 확률과정 - VAR & IRP (백터자기회귀과정, 임펄스응답함수)

다변량 선형 확률과정 필요성 단변량 시계열(Simple/Multiple포함)은 종속변수(Y_t)가 독립변수들에만! 영향을 받는다는 큰 가정 존재 현실적으론 종속변수와 독립변수는 상호 영향을 주고받음 예시:

ysyblog.tistory.com

1️⃣ 다변량 시계열

- 종속변수(Y_t)가 독립변수들에만 영향 받음

- 2차원(소득, 지출 : 종속변수) 과거 1시점가지만을 고려하는 벡터자기회귀 알고리즘

💗 벡터자기회귀 모형

1) VAR 알고리즘

- 평균 벡터와 공분산 벡터가 시차에만 의존하고 각각의 절대위치에 독립적인 정상성 시계열

2) 임펄스 응답 함수

- 여러개의 시계열 상호 상관관계를 기반으로 각각의 변수가 다른 변수에 어떤 영향을 주는지 임펄스 반응 함수로 알 수 있음

- 임펄스 : 어떤 시계열이 t = 0 일 때 1이고, t < 0 or t > 0 일 때 0

- 임펄스 형태의 시계열이 다른 시계열에 미치는 영향을 시간에 따라 표시

2️⃣ 코드 구현

💗 데이터 로딩 및 시각화

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import statsmodels

import statsmodels.api as sm

raw = sm.datasets.macrodata.load_pandas().data

dates_info = raw[['year', 'quarter']].astype(int).astype(str)

raw.index = pd.DatetimeIndex(sm.tsa.datetools.dates_from_str(dates_info['year'] + 'Q'+ dates_info['quarter']))

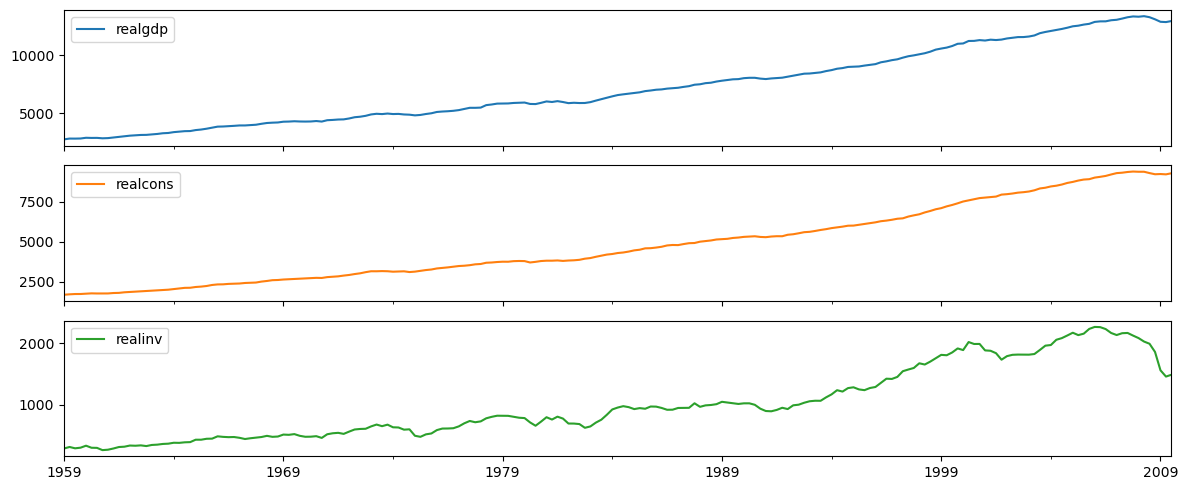

raw_use = raw.iloc[:, 2:5]- 실제 GDP = 실제 CON(소비) + 실제 INV(투자)

raw_use.plot(subplots = True, figsize = (12, 5))

plt.tight_layout()

plt.show()

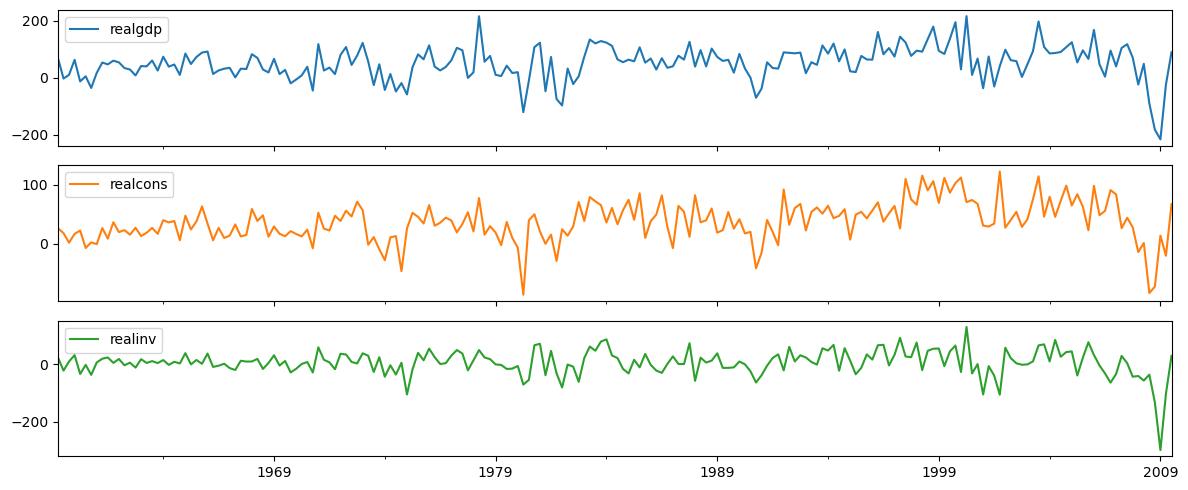

raw_use.diff(1).dropna().plot(subplots = True, figsize = (12, 5))

plt.tight_layout()

plt.show()

💗 VAR 모형

- realgdp : realgdp, realcon, realinv 의 시차 L1 모두와 realcon의 시차 L2에 영향

- realcon : realgdp, realcon, realinv 에 시차 L1, L2 모두 영향

- realinv : realgdp, realcon, realinv 에 시차 L1 만 영향

- realcon, realgdp, realinv 순으로 가장 다른 변수에 영향 많이 받음

raw_use_return = raw_use.diff(1).dropna()

fit = sm.tsa.VAR(raw_use_return).fit(maxlags = 2)

display(fit.summary())

💗 모형 예측 및 시각화

forecast_num = 20

# 점추정

# pre_var = fit.forecast(fit.model.endog[-1:], steps = forecast_num)

# 구간추정

# pre_var_ci = fit.forecast_interval(fit.model.endog[-1:], steps = forecast_num)

fit.plot_forecast(forecast_num)

plt.tight_layout()

plt.show()

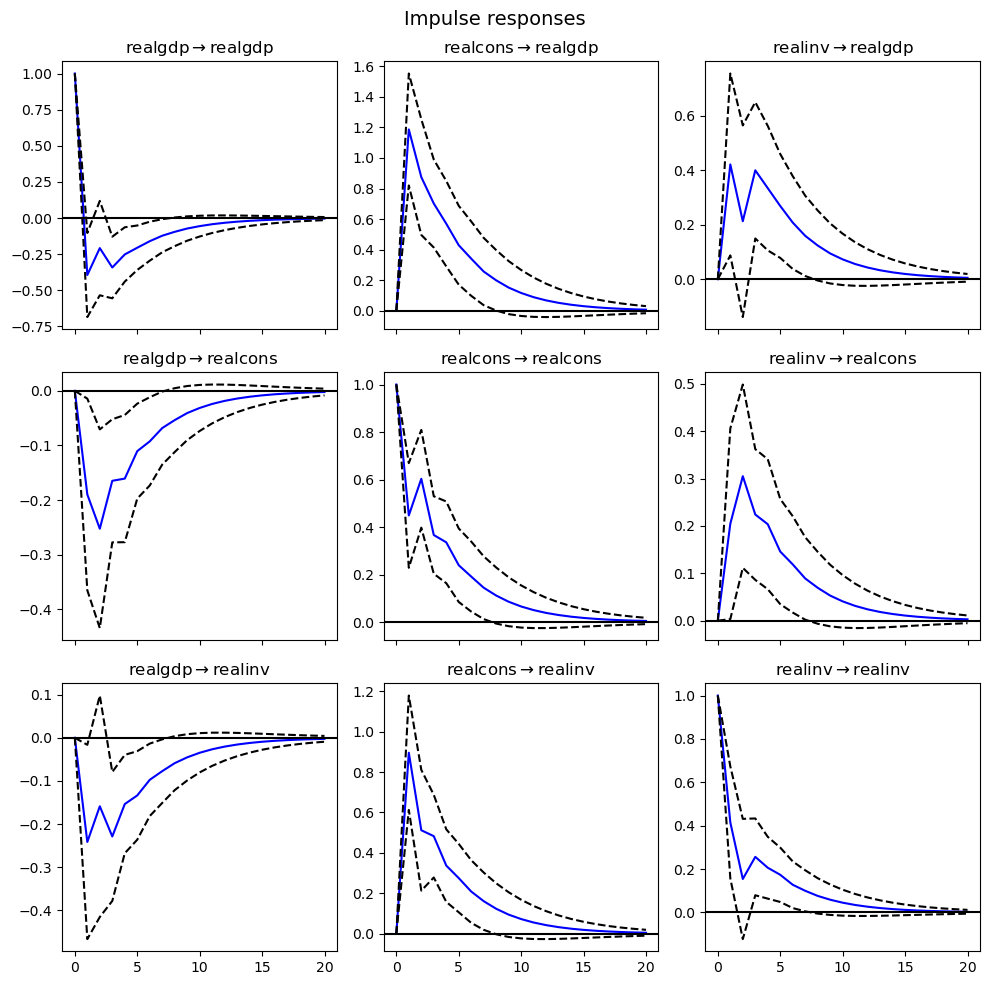

- 임펄스 반응 함수

- realgdp -> realgdp : 단기적으로 음수로 바뀌지만 0으로 수렴

- realgdp -> realcons : gdp가 증가, 소비가 감소하다가 늘어남

- realinv -> realcons : 실제 투자가 증가하면서 실제 소비 증가하다가 0으로 수렴

- realcon -> realgdp : 소비가 증가하면 실제 gdp가 상당히 증가하다가 0으로 수렴

- realinv -> realgdp : 투자가 증가하면 실제 gdp가 소폭 증가하다가 0으로 수렴

fit.irf(forecast_num).plot()

plt.tight_layout()

plt.show()

💗 잔차진단

fit.plot_acorr()

plt.tight_layout()

plt.show()

728x90

반응형

'👩💻 인공지능 (ML & DL) > Serial Data' 카테고리의 다른 글

| Time series 시계열 데이터 분류하기 (0) | 2022.10.06 |

|---|---|

| [교과서 리뷰] Forecasting: Principles and Practice (1) | 2022.10.05 |

| 자기 상관(AutoCorrelation)이 강한 시계열 데이터 학습하기 (1) | 2022.09.28 |

| 시계열 데이터 분석 순서 (Time Series Analysis Order) (0) | 2022.09.28 |

| 다변량 시계열 데이터 1 (Multivariate Time Series Data) (0) | 2022.09.28 |

Comments